The consumption of electricity in homes has been increasing over the years. It varies from season to season. If a household gets an electricity bill of Rs. 2000 during the rainy season, it can easily go up to Rs. 5000 during hot summer days, which is expensive for a common man. The family also does not want to run ACs at free will and are more cautious when running an AC at home because he is scared of the high electricity bill. In such a situation, a homeowner starts looking for alternatives to reduce his electricity bill. One such super-effective alternative is the application of solar energy and generating free power. But people often face a few challenges when installing a solar system. These are:

i) No loan financing available for solar system installation andii) Availing Net Meters for the solar system.

Now let’s learn about how to face these challenges while installing a solar system.

Can we get a loan on the solar system?

Buying a solar system is just like buying any other product like a car. Come to think of it, the purchase and ownership of mobile phones, cars, or homes have become convenient these days due to the easy availability of loans and EMI options. Everyone knows how to buy mobile phones, cars, and homes on EMI but do you know how to buy a solar system on loan?

Anyone holding a credit card can easily avail the EMI option on a solar system, but do debit cardholders have this facility? About 80 crores Indians are bank cardholders, out of which nearly 30 crores people own Pradhan Mantri Jan Dhan Yojana debit card (ATM card). Only 50 lakh people i.e. approximately 1% have credit cards that allow them to avail EMI option on the installation of solar systems.

There are two ways of availing loans on a solar system.

Option 1: Buy Solar Panel on EMI with Debit Card

A few banks such as SBI, HDFC Bank, Axis Bank, ICICI Bank, Kotak Mahindra Bank, and Federal Bank have already made it easier to avail loan facility by allowing to check the Loan Eligibility Criteria.

A potential customer has to send an SMS like DCEMI<SPACE><last digits of Debit Card Number> to 56767, in case he has an account with HDFC bank. One should use the same mobile number to send this text message, as is registered with the bank. You will get a reply with your loan status on the same number. If you will be eligible, you will get a message regarding your eligibility amount in the message itself. The chance of loan approval is just 0.02% and the cardholder’s approval for a loan depends on the bank’s internal database/ criteria.

Similarly, you can try for other banks like:

- SBI Bank – SMS DCEMI to 567676 from your registered mobile number

- ICICI Bank – SMS DCEMI<SPACE><last 4 digits of Debit Card number> to 5676766

- Axis Bank - SMS DCEMI<SPACE><last 4 digits of Debit Card number> to 5676782

- Kotak Bank - SMS DCEMI<SPACE><last 4 digits of Debit Card number> to 5676788

- Federal Bank - SMS DC<SPACE>EMI to 9008915353 or give a missed call to 7812900900

Option 2: Way to Get Home Improvement Loan from the Bank

A few banks like the State Bank of India grants loans of up to Rs.1 lakh for home improvement with an interest rate of nearly 8%. The loan term is 4-5 years or more. A customer can avail of such loans for installing the solar system.

What does a customer need to avail of a loan for Home Improvement?

STEP 1. He needs to visit the nearest bank branch of his area and find out about the bank’s policy on the Home Improvement loan.

STEP 2. The next step is to contact any dealer or a distributor of a private solar company like Loom Solar in your area. They will give a quotation of the size of the solar system that the customer needs to install on their own letterhead. This letter is needed for availing of the loan.

STEP 3. Now the bank will transfer nearly 80% of the total price of the solar system to the private company’s reseller’s bank account. It might take around 5-7 days for the whole process.

STEP 4. Then the reseller of the private company will install the solar system at the customer’s premises. When the customer hands over the NOC to the reseller, the bank transfers the balance 20% to the reseller’s bank account.

What does a reseller need to do to install a solar system?

Any person or a small firm interested to start a business of installing solar systems should get in touch with private solar companies like Loom Solar. All they need is:

1. A shop2. The GST number for that area

3. Free funds of Rs. 25,000 - 1,00,000 for investment.

If the above criteria are satisfied they can easily become a dealer or a distributor of a private solar company.

In short, you will know that how can you save your income tax using solar power? Many banks give home improvement loan for home decorations, such as buying furniture, solar panel installation, home painting, home reconstruction, buying home appliances, etc.

What are the Tax Benefits of Installing A solar system?

Any professional person who is working in a job and earns Rs. 5 lakhs or more in a year, they can claim tax benefits by treating solar system installation as an expense in their ITR.

Budget has announced a new tax regime giving taxpayers an option to pay taxes as per the new tax slabs.

| Total Income (Rs) | Tax Rate |

|---|---|

| Up to Rs 2.5 lakh | Nil |

| From 2,50,001 to Rs 5,00,000 | 5% |

|

From 5,00,001 to Rs 7,50,000 |

10% |

|

From 7,50,001 to 10,00,000 |

15% |

|

From 10,00,001 to Rs 12,50,000 |

20% |

|

From 12,50,001 to 15,00,000 |

25% |

|

Above 15,00,000 |

30% |

A potential customer can easily avail of a home improvement or Renovation loan from the bank in connection to installing a solar system in his house. It will be easier for him to get the loan if he already has a home loan with the bank as the bank will have proof of the customer’s credibility. In case, he does not have an existing home loan with the bank, he can still avail of the loan with relevant documentation. After he gets approved for the home improvement loan, the customer can claim it as an expense in his ITR as an exemption/ deduction from his total income.

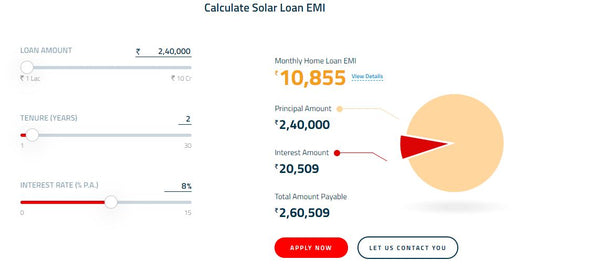

Suppose, there is a potential customer with monthly income of Rs. 75,000 (Rs. 9,00,000 per annum) who is interested in buying a Solar System. This customer has bought a 3kW Solar System for his home at Rs 240,000 on a home improvement loan. The Loan tenure (1 year to 30 years) will be determined on the basis of the person’s age. The customer can then negotiate his EMI plan as per his comfort and earnings. If the customer pays an EMI Rs 15,000 per month, then his annual EMI obligation will be Rs 180,000 and it will be subtracted from his total annual income. Now, the customer has to pay income tax on the balance (i.e. Rs. 9,00,000 - Rs. 1,80,000) Rs 720,000. For more information, you can contact the nearest loan department of the bank branch.

What are the risks involved in this job?

The major risk involved in this job is if a customer is unable to repay the loan amount to the bank, the bank will go to the reseller company for recovery.

2. Net Meter for the solar system

A net meter shows solar production (Export), grid consumption (Import), and net consumption.

What do you need to get a Net Meter?

There are 4 basic steps you have to follow for net meter. Below are given:

1. Check Sanctioned Load on Electricity Bill

If you need to install a net meter, you will have to check the sanctioned load of your electricity meter. A net meter must be a minimum of 3 kW capacity. If any customer has a net meter of lower capacity, he should first get it upgraded to 3 kW capacity. Once this is done, the customer can install nearly 80% of the approved meter capacity at his premises.

2.Visit Your Local Electricity Department

To find more about this, a customer might need to visit his electricity office.

3. Install Solar System in Your Home

Next he needs to purchase a solar system.

4. Install Net Meter

A net meter can be installed only after the installation of the solar system is complete.

Every state has a different net metering policy. To know more, click here.

List of Banks in India for Rooftop Solar Finance

In India, many banking and non-banking services offer easy solar finance for rooftop solar installation. Below is the list of banks that provide homes with solar loans / easy EMI,

1. HDFC Bank Rooftop Solar Finance

HDFC is the largest private sector bank of India in terms of its assets and market capitalization. It is the third-largest company listed by the Indian Stock Exchanges. HDFC Bank Limited offers banking and financial services to its customers and has its headquarters in Mumbai, Maharashtra. Find out more information here:https://www.loomsolar.com/blogs/rooftop-solar-finance/hdfc-home-loan-with-solar-rate

2. SBI Rooftop Solar Finance

The Government of India has set an ambitious target of installation of Grid Connected Rooftop Solar Photovoltaic (GC-RSPV) projects with capacity aggregating 40 GW out of total incremental target of 175 GW of Renewable Energy capacity by 2022. Find out more information here:https://www.loomsolar.com/blogs/rooftop-solar-finance/sbi-home-loan-with-solar-rate

Conclusion

The most common questions in installing a solar system are what will be the total cost, can I get a loan or EMI option and where can I get the net meters? You can contact Faridabad’s Loom Solar Company has installed grid-connected solar systems on loans and net meters at many customers’ home premises.

108 comments

Cecil Hugh

All thanks to God Almighty who use Dr. Guba to cure me from Herpes virus with his herbal Medicine, For those suffering from the same Virus You can contact his WhatsApp +2347077581439, he can also cure your health issues Like HBP, Hepatitis B Virus, Herpes, HPV, ALS etc. Email him atdrgubahealingherbs@gmail.com, or website: https://drgubahealingherbs.wixsite.com/guba-healing-herbs

Michael Daveport

I was recently scammed out of $53,000 by a fraudulent Bitcoin investment scheme, which added significant stress to my already difficult health issues, as I was also facing cancer surgery expenses. Desperate to recover my funds, I spent hours researching and consulting other victims, which led me to discover the excellent reputation of Capital Crypto Recover, I came across a Google post It was only after spending many hours researching and asking other victims for advice that I discovered Capital Crypto Recovery’s stellar reputation. I decided to contact them because of their successful recovery record and encouraging client testimonials. I had no idea that this would be the pivotal moment in my fight against cryptocurrency theft. Thanks to their expert team, I was able to recover my lost cryptocurrency back. The process was intricate, but Capital Crypto Recovery’s commitment to utilizing the latest technology ensured a successful outcome. I highly recommend their services to anyone who has fallen victim to cryptocurrency fraud. For assistance contact Recoverycapital@fastservice.com and on Telegram OR Call Number +1 (336)390-6684 via email: Capitalcryptorecover@zohomail.com you can visit his website: https://recovercapital.wixsite.com/capital-crypto-rec-1

Rogermeyer

What To Do When You Fall Victim To A Crypto Scam.

Contact info:

Email: SMITHWHITEHACKSERVICE@GMAIL.COM

W/A: +1 (559) 508 (2403)

Getting back stolen crypto can be an uphill battle, but there are Experts like SMITHWHITE HACK SERVICE that Can help you recover your lost Bitcoin. To ensure a positive outcome on recovery of lost Assets, SMITHWHITE HACK SERVICE starts the cryptocurrency scam recovery process by examining the narrative of events and the timeline of the scheme. Then, he later analyzes the available data & traces your virtual assets. Get in touch with SMITHWHITE HACK SERVICE to recover your lost Bitcoin.

Patricia Lovick

How To Recover Your Bitcoin Without Falling Victim To Scams: A Testimony Experience With Capital Crypto Recover Services, Contact Telegram: @Capitalcryptorecover

Dear Everyone,

I would like to take a moment to share my positive experience with Capital Crypto Recover Services. Initially, I was unsure if it would be possible to recover my stolen bitcoins. However, with their expertise and professionalism, I was able to fully recover my funds. Unfortunately, many individuals fall victim to scams in the cryptocurrency space, especially those involving fraudulent investment platforms. However, I advise caution, as not all recovery services are legitimate. I personally lost $273,000 worth of Bitcoin from my Binance account due to a deceptive platform. If you have suffered a similar loss, you may be considering crypto recovery, The Capital Crypto Recover is the most knowledgeable and effective Capital Crypto Recovery Services assisted me in recovering my stolen funds within 24 hours, after getting access to my wallet. Their service was not only prompt but also highly professional and effective, and many recovery services may not be trustworthy. Therefore, I highly recommend Capital Crypto Recover to you. i do always research and see reviews about their service, For assistance finding your misplaced cryptocurrency, get in touch with them, They do their jobs quickly and excellently, Stay safe and vigilant in the crypto world.

You can reach them via email at Capitalcryptorecover@zohomail.com OR Call/Text Number +1 (336)390-6684

Patricia Lovick

How To Recover Your Bitcoin Without Falling Victim To Scams: A Testimony Experience With Capital Crypto Recover Services, Contact Telegram: @Capitalcryptorecover

Dear Everyone,

I would like to take a moment to share my positive experience with Capital Crypto Recover Services. Initially, I was unsure if it would be possible to recover my stolen bitcoins. However, with their expertise and professionalism, I was able to fully recover my funds. Unfortunately, many individuals fall victim to scams in the cryptocurrency space, especially those involving fraudulent investment platforms. However, I advise caution, as not all recovery services are legitimate. I personally lost $273,000 worth of Bitcoin from my Binance account due to a deceptive platform. If you have suffered a similar loss, you may be considering crypto recovery, The Capital Crypto Recover is the most knowledgeable and effective Capital Crypto Recovery Services assisted me in recovering my stolen funds within 24 hours, after getting access to my wallet. Their service was not only prompt but also highly professional and effective, and many recovery services may not be trustworthy. Therefore, I highly recommend Capital Crypto Recover to you. i do always research and see reviews about their service, For assistance finding your misplaced cryptocurrency, get in touch with them, They do their jobs quickly and excellently, Stay safe and vigilant in the crypto world.

You can reach them via email at Capitalcryptorecover@zohomail.com OR Call/Text Number +1 (336)390-6684

Gibson

I want to share this wonderful testimony to the Good people all over the world on how I was able to Enlarge my Penis by Dr. Ikpoko on YouTube I was living a shameful life from my young age, just last month as I was browsing on the internet about Penis size and Enlargement Products, I saw a testimony of a Man called Ben , testifying of how he was able to get his penis Enlarged by Dr.Ikpoko and I decided to also Email Dr IKPOKO for my small penis size and he quickly respond to me and gave me the normal instructions which i did and then he shipped the product to me here in the united state which i received in just 4 working days and today i am very happy because i started seeing positive changes in my penis size in just 21 days of use. Dr Ikpoko on YouTube herbal product is the best recommended for you and to whomever suffering from this shame or having any other diseases as well should Contact this great herbal doctor via his Whatsapp +2348108298045 Email : drikpoko@gmail.com and website: https://drikpoko.wixsite.com/herbs

Marcus Henderson

Bitcoin Recovery Testimonial

After falling victim to a cryptocurrency scam group, I lost $354,000 worth of USDT. I thought all hope was lost from the experience of losing my hard-earned money to scammers. I was devastated and believed there was no way to recover my funds. Fortunately, I started searching for help to recover my stolen funds and I came across a lot of testimonials online about Capital Crypto Recovery, an agent who helps in recovery of lost bitcoin funds, I contacted Capital Crypto Recover Service, and with their expertise, they successfully traced and recovered my stolen assets.

Their team was professional, kept me updated throughout the process, and demonstrated a deep understanding of blockchain transactions and recovery protocols. They are trusted and very reliable with a 100% successful rate record Recovery bitcoin, I’m grateful for their help and highly recommend their services to anyone seeking assistance with lost crypto.

Contact: Capitalcryptorecover@zohomail.com

Phone CALL/Text Number: +1 (336) 390-6684

Email: Recovercapital@cyberservices.com

Website: https://recovercapital.wixsite.com/capital-crypto-rec-1

Heather Delaney

Are you searching for a real spell caster ?

It is amazing how quickly Dr. Excellent brought my husband back to me.

My name is Heather Delaney. I married the love of my life Riley on 10/02/15 and we now have two beautiful girls Abby & Erin, who are conjoined twins, that were born 07/24/16. My husband left me and moved to be with another woman. I felt my life was over and my kids thought they would never see their father again. I tried to be strong just for the kids but I could not control the pains that tormented my heart, my heart was filled with sorrows and pains because I was really in love with my husband. I have tried many options but he did not come back, until i met a friend that directed me to Dr. Excellent a spell caster, who helped me to bring back my husband after 11hours. Me and my husband are living happily together again, This man is powerful, contact Dr.Excellent if you are passing through any difficulty in life or having troubles in your marriage or relationship, he is capable of making things right for you. Don’t miss out on the opportunity to work with the best spell caster.

Here his contact. Call/WhatsApp him at: +2348084273514 "

Or email him at: Excellentspellcaster@gmail.com ,

For more information visit his website:https://drexcellentspellcaster.godaddysites.com

Marcus Henderson

Bitcoin Recovery Testimonial

After falling victim to a cryptocurrency scam group, I lost $354,000 worth of USDT. I thought all hope was lost from the experience of losing my hard-earned money to scammers. I was devastated and believed there was no way to recover my funds. Fortunately, I started searching for help to recover my stolen funds and I came across a lot of testimonials online about Capital Crypto Recovery, an agent who helps in recovery of lost bitcoin funds, I contacted Capital Crypto Recover Service, and with their expertise, they successfully traced and recovered my stolen assets.

Their team was professional, kept me updated throughout the process, and demonstrated a deep understanding of blockchain transactions and recovery protocols. They are trusted and very reliable with a 100% successful rate record Recovery bitcoin, I’m grateful for their help and highly recommend their services to anyone seeking assistance with lost crypto.

Contact: Capitalcryptorecover@zohomail.com

Phone CALL/Text Number: +1 (336) 390-6684

Email: Recovercapital@cyberservices.com

Website: https://recovercapital.wixsite.com/capital-crypto-rec-1

Reese Morebi

We can help you solve all HACKING RELATED PROBLEMS

●Hacking of all social media accounts

●Spying on cheating partner

●Retrieving of lost Cryptocurrency

●Data alteration

●Finding of lost phone

●Clearing/paying off of mortgage/loan

●Increasing of credit score

●Bitcoin mining

●Tracking of location

●Hacking of cell phone/other devices

●Block out or track down hackers

Secure yourself now!!!

Contact: cyberhelpdesk88@gmail.com

WhatsApp: +1 (209) 809-0176

Telegram: +1 (209) 809-0176

MICHAEL GARD

Srdačan pozdrav svima koji čitaju ovu poruku i želim da znate da ova poruka nije slučajna ili slučajna. Kao uvod, iz Zagreba sam i nisam mogao vjerovati kako sam dobio kredit od 200.000,00 eura. Ponovno sam sretan i financijski stabilan i hvala Bogu što takve kreditne tvrtke još uvijek postoje. Znam da prevaranata ima posvuda i bio sam žrtva prijevare prije dok nisam upoznao ovu pouzdanu tvrtku koja mi je pokazala sve što trebam znati o kreditima i ulaganjima. Ova tvrtka me savjetovala i pomogla, pa ću savjetovati svima kojima je potreban kredit da iskoriste ovu priliku kako bi se izvukli iz financijskih poteškoća. Možete ih kontaktirati putem e-pošte (hybridalliantcreditunion@gmail.com). Brzo kontaktirajte (hybridalliantcreditunion@gmail.com) danas i ostvarite svoj kredit od njih uz kamatnu stopu od 3%. Obavezno kontaktirajte Alliant Credit Union Company i svi vaši financijski problemi bit će riješeni.

Surađuju s odjelima za procjenu rizika, obradu, financiranje i drugim odjelima. Svaki od ovih timova dolazi s ogromnim bogatstvom znanja. To im omogućuje da steknu više znanja o kreditima i pruže bolje iskustvo članovima. Ostvarite svoju financijsku slobodu od njih danas i zahvalite mi kasnije. Jeste li u dugovima, trebate kredit, brz i pouzdan, ovo je mjesto za dobivanje vjerodostojnih kredita. Nude poslovne kredite, studentske kredite, stambene kredite, osobne kredite itd. Kamatna stopa kredita je 3%. Kontaktirajte nas danas. Imate priliku dobiti gotovinski kredit u iznosu od 2000 (€$£) – 5.000.000 – 100.000.000 (€$£) s mogućnostima otplate od 1 godine do 45 godina bez jamstva za nekretnine. Viber: +385915608706

WhatsApp: +385915608706

E-pošta: hybridalliantcreditunion@gmail.com

© 2025 Alliant Credit Union

Web stranica: https://www.alliantcreditunion.org

11545 W. Touhy Ave., Chicago, IL 60666

Broj usmjeravanja: 271081528

Angela Cook

HERBALIST IKPOKO QUICK CURE FOR STDS AND OTHER INFECTIONS OR DISEASES . HIS WEBSITE : https://drikpoko.wixsite.com/herbs

Bringing antiviral foods into your diet is an important part of healing from any herpes virus. All fruits and vegetables are antiviral. For that reason, try filling your diet with as many fresh fruits and veggies as you can! Many herbs and spices can provide antiviral support as well. As you enjoy these foods, you can be at peace knowing that none of the herpes viruses are being fed or strengthened by these life-giving foods. Get More enlightened on Doctor Ikpoko Website : These foods can be incredibly supportive when regularly included in your diet, i was a carrier of herpes 2 for over 15 Months, But i Thank Herbalist IKPOKO for enlightening me and also helping me Permanently Get rid of My herpes Virus. May God Grant you the strength to keep Helping lives with your Herbal Medicine And Wisdom. Contact Dr Ikpoko on YouTube via Whatsapp : +2348108298045 On his email : drikpoko@gmail.com website: https://drikpoko.wixsite.com/herbs

Marcus Henderson

Bitcoin Recovery Testimonial

After falling victim to a cryptocurrency scam group, I lost $354,000 worth of USDT. I thought all hope was lost from the experience of losing my hard-earned money to scammers. I was devastated and believed there was no way to recover my funds. Fortunately, I started searching for help to recover my stolen funds and I came across a lot of testimonials online about Capital Crypto Recovery, an agent who helps in recovery of lost bitcoin funds, I contacted Capital Crypto Recover Service, and with their expertise, they successfully traced and recovered my stolen assets.

Their team was professional, kept me updated throughout the process, and demonstrated a deep understanding of blockchain transactions and recovery protocols. They are trusted and very reliable with a 100% successful rate record Recovery bitcoin, I’m grateful for their help and highly recommend their services to anyone seeking assistance with lost crypto.

Contact: Capitalcryptorecover@zohomail.com

Phone CALL/Text Number: +1 (336) 390-6684

Email: Recovercapital@cyberservices.com

Website: https://recovercapital.wixsite.com/capital-crypto-rec-1

Nancy Austin

URGENT AND EFFECTIVE LOVE SPELL CASTER TO HELP YOU GET BACK YOUR EX LOVER, HUSBAND/BOYFRIEND OR WIFE/GIRLFRIEND VERY FAST CONTACT HIM VIA EMAIL: PSYCHICSPIRITUALREALM@GMAIL.COM OR WHATSAPP NUMBER : +14242983869

I’m so excited my broken Marriage been restored. My ex lover is back after he left me and our kids for another woman. I was so happy to meet Dr Gerald and how he helped many people to bring their lover back so I contacted him to help me too. That was how Dr Gerald helped me to bring my lover back. A big thank you to Dr Gerald because I never thought my ex lover would be back to me so quickly with your spell. You are the best and the world greatest. If you are here and you need your Ex Lover back or your lover moved to another woman, do not cry anymore, contact this powerful spell caster now. Here’s his contact: Email: psychicspiritualrealm@gmail.com OR WhatsApp: +14242983869

FIX THE FOLLOWING PROBLEMS TO ALL ACROSS THE

GLOBE ON:

Get your ex back spell

Lottery Spell

Love/Reunion Spell

Pregnancy Spell

Protection Spell

Freedom From Prison Spell

Marriage spell

Killing/Revenge spell

Healing/Cure spell

He is capable of curing HIV/AIDS, HERPES, HPV, HSV1&2, CANCER of all kinds,DIABETES and so many other infections.

Email: psychicspiritualrealm@gmail.com

WhatsApp: +14242983869

Facebook Page: https://facebook.com/Psychicspiritualrealm

Wendy Taylor

My name is Wendy Taylor, I’m from Los Angeles, i want to announce to you Viewer how Capital Crypto Recover help me to restore my Lost Bitcoin, I invested with a Crypto broker without proper research to know what I was hoarding my hard-earned money into scammers, i lost access to my crypto wallet or had your funds stolen? Don’t worry Capital Crypto Recover is here to help you recover your cryptocurrency with cutting-edge technical expertise, With years of experience in the crypto world, Capital Crypto Recover employs the best latest tools and ethical hacking techniques to help you recover lost assets, unlock hacked accounts, Whether it’s a forgotten password, Capital Crypto Recover has the expertise to help you get your crypto back. a security company service that has a 100% success rate in the recovery of crypto assets, i lost wallet and hacked accounts. I provided them the information they requested and they began their investigation. To my surprise, Capital Crypto Recover was able to trace and recover my crypto assets successfully within 24hours. Thank you for your service in helping me recover my $647,734 worth of crypto funds and I highly recommend their recovery services, they are reliable and a trusted company to any individuals looking to recover lost money. Contact email Capitalcryptorecover@zohomail.com OR Telegram Capitalcryptorecover Call/Text Number +1 (336)390-6684 his contact: Recovercapitalcyberservices.com His website: https://recovercapital.wixsite.com/capital-crypto-rec-1

Suzan Franco

HIRE THE BEST CRYPTO ASSET RECOVERY EXPERT THE HACK ANGELS

I just have to testify about this here and let everyone know how much better I feel right now. I was devastated when I learned I had been scammed over $860,O00 worth of bitcoin to a fake investor online that I came across just last three mouths, before this happened, i tried reaching the team but i did not get any feedback, for several weeks, at some point I thought about getting a hacker to see if that will help and then I read about a team called THE HACK ANGELS RECOVERY EXPERT. They helped people retrieve their lost funds. I reached out to them without hesitating and the outcome was wonderful. The Hack Angels is the best bitcoin recovery expert to carry out your request and provide solutions to your bitcoin recovery problems. If you ever find yourself in a similar predicament. I highly recommend THE HACK ANGELS RECOVERY EXPERT to everyone out there, contact him through

Email at support@thehackangels.com

Website at www.thehackangels.com

WhatsApp +1(520)2 0 0-2 3 2 0

They are truly a Godsend. Thank you for the heroic work you do for the helpless

Patricia Lovick

How To Recover Your Bitcoin Without Falling Victim To Scams: A Testimony Experience With Capital Crypto Recover Services, Contact Telegram: @Capitalcryptorecover

Dear Everyone,

I would like to take a moment to share my positive experience with Capital Crypto Recover Services. Initially, I was unsure if it would be possible to recover my stolen bitcoins. However, with their expertise and professionalism, I was able to fully recover my funds. Unfortunately, many individuals fall victim to scams in the cryptocurrency space, especially those involving fraudulent investment platforms. However, I advise caution, as not all recovery services are legitimate. I personally lost $273,000 worth of Bitcoin from my Binance account due to a deceptive platform. If you have suffered a similar loss, you may be considering crypto recovery, The Capital Crypto Recover is the most knowledgeable and effective Capital Crypto Recovery Services assisted me in recovering my stolen funds within 24 hours, after getting access to my wallet. Their service was not only prompt but also highly professional and effective, and many recovery services may not be trustworthy. Therefore, I highly recommend Capital Crypto Recover to you. i do always research and see reviews about their service, For assistance finding your misplaced cryptocurrency, get in touch with them, They do their jobs quickly and excellently, Stay safe and vigilant in the crypto world.

You can reach them via email at Capitalcryptorecover@zohomail.com OR Call/Text Number +1 (336)390-6684 his contact: Recovercapital@cyberservices.com His website: https://recovercapital.wixsite.com/capital-crypto-rec-1

renne brandon

I am forever grateful to the amazing team at Dune Nectar Web Expert. They did what I thought was never possible. They played a crucial role in helping me recover all my lost funds from a fraudulent forex and crypto trading scheme, including the pråofits I thought I’d earned. Looking back, I realize I was a bit of a fool for trusting greedy and deceitful brokers with my hard-earned money. However, I’m overjoyed that I found Dune Nectar Web Expert. They are a team of honest and highly skilled professionals available for hire. Dune Nectar Web Expert helps individuals and organizations recover stolen cryptocurrencies and digital assets. They helped me heal every penny I lost and provided me with the right signals and a reliable platform to trade with. Thanks to Dune Nectar Web Expert, I’m earning more than ever, and I couldn’t be happier. That’s why I can’t stop sharing my positive experience and praising their amazing services and expertise. If you’re still struggling with failures in binary options, crypto, or forex trading, or if you’re looking to recover your lost USDC, Bitcoin, Ethereum, or other crypto funds, I strongly advise you to reach out to:

Telegram>>> ( T.me/dunenectarwebexpert )

Mail>>>> Support (@) Dunenectarwebexpert (.) Com

Web>>> https://dunenectarwebexpert.com/

Robert Alfred

CRYPTO SCAM RECOVERY SUCCESSFUL – A TESTIMONIAL OF LOST PASSWORD TO YOUR DIGITAL WALLET BACK.

My name is Robert Alfred, Am from Australia. I’m sharing my experience in the hope that it helps others who have been victims of crypto scams. A few months ago, I fell victim to a fraudulent crypto investment scheme linked to a broker company. I had invested heavily during a time when Bitcoin prices were rising, thinking it was a good opportunity. Unfortunately, I was scammed out of $120,000 AUD and the broker denied me access to my digital wallet and assets. It was a devastating experience that caused many sleepless nights. Crypto scams are increasingly common and often involve fake trading platforms, phishing attacks, and misleading investment opportunities. In my desperation, a friend from the crypto community recommended Capital Crypto Recovery Service, known for helping victims recover lost or stolen funds. After doing some research and reading multiple positive reviews, I reached out to Capital Crypto Recovery. I provided all the necessary information—wallet addresses, transaction history, and communication logs. Their expert team responded immediately and began investigating. Using advanced blockchain tracking techniques, they were able to trace the stolen Dogecoin, identify the scammer’s wallet, and coordinate with relevant authorities to freeze the funds before they could be moved. Incredibly, within 24 hours, Capital Crypto Recovery successfully recovered the majority of my stolen crypto assets. I was beyond relieved and truly grateful. Their professionalism, transparency, and constant communication throughout the process gave me hope during a very difficult time. If you’ve been a victim of a crypto scam, I highly recommend them with full confidence contacting:

📧 Email: Recovercapital@cyberservices.com

📱 Telegram: @Capitalcryptorecover

📞 Call/Text: +1 (336) 390-6684

🌐 Website: https://recovercapital.wixsite.com/capital-crypto-rec-1

Robert Alfred

CRYPTO SCAM RECOVERY SUCCESSFUL – A TESTIMONIAL OF LOST PASSWORD TO YOUR DIGITAL WALLET BACK.

My name is Robert Alfred, Am from Australia. I’m sharing my experience in the hope that it helps others who have been victims of crypto scams. A few months ago, I fell victim to a fraudulent crypto investment scheme linked to a broker company. I had invested heavily during a time when Bitcoin prices were rising, thinking it was a good opportunity. Unfortunately, I was scammed out of $120,000 AUD and the broker denied me access to my digital wallet and assets. It was a devastating experience that caused many sleepless nights. Crypto scams are increasingly common and often involve fake trading platforms, phishing attacks, and misleading investment opportunities. In my desperation, a friend from the crypto community recommended Capital Crypto Recovery Service, known for helping victims recover lost or stolen funds. After doing some research and reading multiple positive reviews, I reached out to Capital Crypto Recovery. I provided all the necessary information—wallet addresses, transaction history, and communication logs. Their expert team responded immediately and began investigating. Using advanced blockchain tracking techniques, they were able to trace the stolen Dogecoin, identify the scammer’s wallet, and coordinate with relevant authorities to freeze the funds before they could be moved. Incredibly, within 24 hours, Capital Crypto Recovery successfully recovered the majority of my stolen crypto assets. I was beyond relieved and truly grateful. Their professionalism, transparency, and constant communication throughout the process gave me hope during a very difficult time. If you’ve been a victim of a crypto scam, I highly recommend them with full confidence contacting:

📧 Email: Recovercapital@cyberservices.com

📱 Telegram: @Capitalcryptorecover

📞 Call/Text: +1 (336) 390-6684

🌐 Website: https://recovercapital.wixsite.com/capital-crypto-rec-1

Verona Jason

HIRE A GENUINE HACKER FOR ALL KINDS OF HACKING JOBS // THE HACK ANGELS

The internet today is full of scammers. But here is some good news to everyone who has been a victim of internet scammers. I have been a victim of online scams. I lost $920,000 worth of BTC. I was devastated when I realized I had fallen victim. I came across a place where so many people recommended THE HACK ANGELS. Hackers who have dedicated time to helping individuals to get back their money from internet scammers. Am here to give glory to THE HACK ANGELS. You guys did a great job for me. And all of this was done at an affordable price. Thanks a lot. To get in touch with the recovery hacker, you can contact them via details below.

WhatsApp +1(520)200-2320

Email at support@thehackangels.com

Website at www.thehackangels.com

Wendy Taylor

My name is Wendy Taylor, I’m from Los Angeles, i want to announce to you Viewer how Capital Crypto Recover help me to restore my Lost Bitcoin, I invested with a Crypto broker without proper research to know what I was hoarding my hard-earned money into scammers, i lost access to my crypto wallet or had your funds stolen? Don’t worry Capital Crypto Recover is here to help you recover your cryptocurrency with cutting-edge technical expertise, With years of experience in the crypto world, Capital Crypto Recover employs the best latest tools and ethical hacking techniques to help you recover lost assets, unlock hacked accounts, Whether it’s a forgotten password, Capital Crypto Recover has the expertise to help you get your crypto back. a security company service that has a 100% success rate in the recovery of crypto assets, i lost wallet and hacked accounts. I provided them the information they requested and they began their investigation. To my surprise, Capital Crypto Recover was able to trace and recover my crypto assets successfully within 24hours. Thank you for your service in helping me recover my $647,734 worth of crypto funds and I highly recommend their recovery services, they are reliable and a trusted company to any individuals looking to recover lost money. Contact email Capitalcryptorecover@zohomail.com OR Telegram Capitalcryptorecover Call/Text Number +1 (336)390-6684 his contact: Recovercapitalcyberservices.com His website: https://recovercapital.wixsite.com/capital-crypto-rec-1

Athony Isak

My heart is so filled with joy. If you are suffering from Erectile dysfunction or any other disease you can contact Dr. Moses Buba on this buba.herbalmiraclemedicine@gmail.com or His website : https://www.facebook.com/profile.php?id=61559577240930 . For more information from me reach me via WhatsApp : +44 7375 301397

Patricia Lovick

How To Recover Your Bitcoin Without Falling Victim To Scams: A Testimony Experience With Capital Crypto Recover Services, Contact Telegram: @Capitalcryptorecover

Dear Everyone,

I would like to take a moment to share my positive experience with Capital Crypto Recover Services. Initially, I was unsure if it would be possible to recover my stolen bitcoins. However, with their expertise and professionalism, I was able to fully recover my funds. Unfortunately, many individuals fall victim to scams in the cryptocurrency space, especially those involving fraudulent investment platforms. However, I advise caution, as not all recovery services are legitimate. I personally lost $273,000 worth of Bitcoin from my Binance account due to a deceptive platform. If you have suffered a similar loss, you may be considering crypto recovery, The Capital Crypto Recover is the most knowledgeable and effective Capital Crypto Recovery Services assisted me in recovering my stolen funds within 24 hours, after getting access to my wallet. Their service was not only prompt but also highly professional and effective, and many recovery services may not be trustworthy. Therefore, I highly recommend Capital Crypto Recover to you. i do always research and see reviews about their service, For assistance finding your misplaced cryptocurrency, get in touch with them, They do their jobs quickly and excellently, Stay safe and vigilant in the crypto world.

You can reach them via email at Capitalcryptorecover@zohomail.com OR Call/Text Number +1 (336)390-6684 his contact: Recovercapital@cyberservices.com His website: https://recovercapital.wixsite.com/capital-crypto-rec-1

Robert Alfred

CRYPTO SCAM RECOVERY SUCCESSFUL – A TESTIMONIAL OF LOST PASSWORD TO YOUR DIGITAL WALLET BACK.

My name is Robert Alfred, Am from Australia. I’m sharing my experience in the hope that it helps others who have been victims of crypto scams. A few months ago, I fell victim to a fraudulent crypto investment scheme linked to a broker company. I had invested heavily during a time when Bitcoin prices were rising, thinking it was a good opportunity. Unfortunately, I was scammed out of $120,000 AUD and the broker denied me access to my digital wallet and assets. It was a devastating experience that caused many sleepless nights. Crypto scams are increasingly common and often involve fake trading platforms, phishing attacks, and misleading investment opportunities. In my desperation, a friend from the crypto community recommended Capital Crypto Recovery Service, known for helping victims recover lost or stolen funds. After doing some research and reading multiple positive reviews, I reached out to Capital Crypto Recovery. I provided all the necessary information—wallet addresses, transaction history, and communication logs. Their expert team responded immediately and began investigating. Using advanced blockchain tracking techniques, they were able to trace the stolen Dogecoin, identify the scammer’s wallet, and coordinate with relevant authorities to freeze the funds before they could be moved. Incredibly, within 24 hours, Capital Crypto Recovery successfully recovered the majority of my stolen crypto assets. I was beyond relieved and truly grateful. Their professionalism, transparency, and constant communication throughout the process gave me hope during a very difficult time. If you’ve been a victim of a crypto scam, I highly recommend them with full confidence contacting:

Email: Recovercapital@cyberservices.com

Telegram: @Capitalcryptorecover

Call/Text: +1 (336) 390-6684

Website: https://recovercapital.wixsite.com/capital-crypto-rec-1

Jane Marcus

THE BLACK MIRROR IS POWERFUL. Who could believe that I would be rich someday? but Baba Powers made it possible with the black mirror which I purchased from him. Thanks to him because the black mirror reveals the secrets, unlock the power. I came across various testimonials which state how the black mirror has been of good and great help to them. I also contacted Baba Powers on his email; Babablackmirrors@gmail.com to also experience it for myself. I am really happy to get the black mirror. Thank you Baba Powers for your special black mirror. You can also view his website and you will see amazing testimonies from people that he has helped. His website is; Babablackmirrorsofpowers.blogspot.com I urge you now to contact him and you will never regret it.

Jane Marcus

THE BLACK MIRROR IS POWERFUL. Who could believe that I would be rich someday? but Baba Powers made it possible with the black mirror which I purchased from him. Thanks to him because the black mirror reveals the secrets, unlock the power. I came across various testimonials which state how the black mirror has been of good and great help to them. I also contacted Baba Powers on his email; Babablackmirrors@gmail.com to also experience it for myself. I am really happy to get the black mirror. Thank you Baba Powers for your special black mirror. You can also view his website and you will see amazing testimonies from people that he has helped. His website is; Babablackmirrorsofpowers.blogspot.com I urge you now to contact him and you will never regret it.

Elizabeth Rush

God bless Capital Crypto Recover Services for the marvelous work you did in my life, I have learned the hard way that even the most sensible investors can fall victim to scams. When my USD was stolen, for anyone who has fallen victim to one of the bitcoin binary investment scams that are currently ongoing, I felt betrayal and upset. But then I was reading a post on site when I saw a testimony of Wendy Taylor online who recommended that Capital Crypto Recovery has helped her recover scammed funds within 24 hours. after reaching out to this cyber security firm that was able to help me recover my stolen digital assets and bitcoin. I’m genuinely blown away by their amazing service and professionalism. I never imagined I’d be able to get my money back until I complained to Capital Crypto Recovery Services about my difficulties and gave all of the necessary paperwork. I was astounded that it took them 12 hours to reclaim my stolen money back. Without a doubt, my USDT assets were successfully recovered from the scam platform, Thank you so much Sir, I strongly recommend Capital Crypto Recover for any of your bitcoin recovery, digital funds recovery, hacking, and cybersecurity concerns.

You reach them Call/Text Number +1 (336)390-6684

His Email: Recovercapital@cyberservices.com

Contact Telegram: @Capitalcryptorecover

His website: https://recovercapital.wixsite.com/capital-crypto-rec-1

Wendy Taylor

My name is Wendy Taylor, I’m from Los Angeles, i want to announce to you Viewer how Capital Crypto Recover help me to restore my Lost Bitcoin, I invested with a Crypto broker without proper research to know what I was hoarding my hard-earned money into scammers, i lost access to my crypto wallet or had your funds stolen? Don’t worry Capital Crypto Recover is here to help you recover your cryptocurrency with cutting-edge technical expertise, With years of experience in the crypto world, Capital Crypto Recover employs the best latest tools and ethical hacking techniques to help you recover lost assets, unlock hacked accounts, Whether it’s a forgotten password, Capital Crypto Recover has the expertise to help you get your crypto back. a security company service that has a 100% success rate in the recovery of crypto assets, i lost wallet and hacked accounts. I provided them the information they requested and they began their investigation. To my surprise, Capital Crypto Recover was able to trace and recover my crypto assets successfully within 24hours. Thank you for your service in helping me recover my $647,734 worth of crypto funds and I highly recommend their recovery services, they are reliable and a trusted company to any individuals looking to recover lost money. Contact email Capitalcryptorecover@zohomail.com OR Telegram Capitalcryptorecover Call/Text Number +1 (336)390-6684 his contact: Recovercapitalcyberservices.com His website: https://recovercapital.wixsite.com/capital-crypto-rec-1

Wendy Taylor

My name is Wendy Taylor, I’m from Los Angeles, i want to announce to you Viewer how Capital Crypto Recover help me to restore my Lost Bitcoin, I invested with a Crypto broker without proper research to know what I was hoarding my hard-earned money into scammers, i lost access to my crypto wallet or had your funds stolen? Don’t worry Capital Crypto Recover is here to help you recover your cryptocurrency with cutting-edge technical expertise, With years of experience in the crypto world, Capital Crypto Recover employs the best latest tools and ethical hacking techniques to help you recover lost assets, unlock hacked accounts, Whether it’s a forgotten password, Capital Crypto Recover has the expertise to help you get your crypto back. a security company service that has a 100% success rate in the recovery of crypto assets, i lost wallet and hacked accounts. I provided them the information they requested and they began their investigation. To my surprise, Capital Crypto Recover was able to trace and recover my crypto assets successfully within 24hours. Thank you for your service in helping me recover my $647,734 worth of crypto funds and I highly recommend their recovery services, they are reliable and a trusted company to any individuals looking to recover lost money. Contact email Capitalcryptorecover@zohomail.com OR Telegram Capitalcryptorecover Call/Text Number +1 (336)390-6684 his contact: Recovercapitalcyberservices.com His website: https://recovercapital.wixsite.com/capital-crypto-rec-1

Karsten Johnson

I’m very hapy today to share this amazing testimony as Dr Ikpoko on YouTube the herbal doctor was able to cure me from my Herpes Virus with his herbal medicine. i am Johnson from Atlanta.Georgia ,I was been a diagnosed of Hsv2 for a period of 2 years and have tried different methods of treatment to ensure that I was cured of this terrible disease, but none worked for me, i so much believed there’s a cure out there somewhere and we’ve been blinded to the facts that medical doctors hides that from us, i was really desperate as I was losing almost everything due to my illness, A few months ago while I was checking the internet I saw different recommendation about Dr Ikpoko on YouTube on how he have been using his herbal Medicine to treat and cure people, I contacted him and I told him how I got his contact and also about my herpes virus, after some time he told me not to worry that he would prepare for me his herbal medicine, he told me I would take this medicine for a week and also it works after using it for 3 weeks, you can reach out to Dr. Ikpoko on YouTube via

Whatsapp: +2348108298045 Email: drikpoko@gmail.com https://drikpoko.wixsite.com/herbs

Robert Alfred

CRYPTO SCAM RECOVERY SUCCESSFUL – A TESTIMONIAL OF LOST PASSWORD TO YOUR DIGITAL WALLET BACK.

My name is Robert Alfred, Am from Australia. I’m sharing my experience in the hope that it helps others who have been victims of crypto scams. A few months ago, I fell victim to a fraudulent crypto investment scheme linked to a broker company. I had invested heavily during a time when Bitcoin prices were rising, thinking it was a good opportunity. Unfortunately, I was scammed out of $120,000 AUD and the broker denied me access to my digital wallet and assets. It was a devastating experience that caused many sleepless nights. Crypto scams are increasingly common and often involve fake trading platforms, phishing attacks, and misleading investment opportunities. In my desperation, a friend from the crypto community recommended Capital Crypto Recovery Service, known for helping victims recover lost or stolen funds. After doing some research and reading multiple positive reviews, I reached out to Capital Crypto Recovery. I provided all the necessary information—wallet addresses, transaction history, and communication logs. Their expert team responded immediately and began investigating. Using advanced blockchain tracking techniques, they were able to trace the stolen Dogecoin, identify the scammer’s wallet, and coordinate with relevant authorities to freeze the funds before they could be moved. Incredibly, within 24 hours, Capital Crypto Recovery successfully recovered the majority of my stolen crypto assets. I was beyond relieved and truly grateful. Their professionalism, transparency, and constant communication throughout the process gave me hope during a very difficult time. If you’ve been a victim of a crypto scam, I highly recommend them with full confidence contacting:

Email: Recovercapital@cyberservices.com

Telegram: @Capitalcryptorecover

Call/Text: +1 (336) 390-6684

Website: https://recovercapital.wixsite.com/capital-crypto-rec-1

Jenifer Zara

HOW I FINALLY GOT MY STOLEN FUNDS BACK // ALL THANKS TO THE HACK ANGELS RECOVERY EXPERT

Have you lost money in a cryptocurrency or online investment scam? Are you desperately searching for help recovering your stolen funds? If you find yourself in such difficulty, get in touch with THE HACK ANGELS RECOVERY EXPERT to recover your scammed funds back. I was devastated when I lost over $975,000 in an investment trading company. I was down because the company refused to let me make withdrawals and kept asking for more money. My friend introduced me to THE HACK ANGELS RECOVERY EXPERT. I was able to recover my money back. They are knowledgeable professionals, and I am grateful for their assistance. You can contact them using the details below

Email: support@thehackangels.com

Website at www.thehackangels.com

WhatsApp +1(520)200-2320

If you’re unsure of what to do next. In a few days, you will see the efforts they took to recover the money they stole from you.

Jenifer Zara

HOW I FINALLY GOT MY STOLEN FUNDS BACK // ALL THANKS TO THE HACK ANGELS RECOVERY EXPERT

Have you lost money in a cryptocurrency or online investment scam? Are you desperately searching for help recovering your stolen funds? If you find yourself in such difficulty, get in touch with THE HACK ANGELS RECOVERY EXPERT to recover your scammed funds back. I was devastated when I lost over $975,000 in an investment trading company. I was down because the company refused to let me make withdrawals and kept asking for more money. My friend introduced me to THE HACK ANGELS RECOVERY EXPERT. I was able to recover my money back. They are knowledgeable professionals, and I am grateful for their assistance. You can contact them using the details below

Email: support@thehackangels.com

Website at www.thehackangels.com

WhatsApp +1(520)200-2320

If you’re unsure of what to do next. In a few days, you will see the efforts they took to recover the money they stole from you.

Jenifer Zara

HOW I FINALLY GOT MY STOLEN FUNDS BACK // ALL THANKS TO THE HACK ANGELS RECOVERY EXPERT

Have you lost money in a cryptocurrency or online investment scam? Are you desperately searching for help recovering your stolen funds? If you find yourself in such difficulty, get in touch with THE HACK ANGELS RECOVERY EXPERT to recover your scammed funds back. I was devastated when I lost over $975,000 in an investment trading company. I was down because the company refused to let me make withdrawals and kept asking for more money. My friend introduced me to THE HACK ANGELS RECOVERY EXPERT. I was able to recover my money back. They are knowledgeable professionals, and I am grateful for their assistance. You can contact them using the details below

Email: support@thehackangels.com

Website at www.thehackangels.com

WhatsApp +1(520)200-2320

If you’re unsure of what to do next. In a few days, you will see the efforts they took to recover the money they stole from you.

Patricia Lovick

How To Recover Your Bitcoin Without Falling Victim To Scams: A Testimony Experience With Capital Crypto Recover Services, Contact Telegram: @Capitalcryptorecover

Dear Everyone,

I would like to take a moment to share my positive experience with Capital Crypto Recover Services. Initially, I was unsure if it would be possible to recover my stolen bitcoins. However, with their expertise and professionalism, I was able to fully recover my funds. Unfortunately, many individuals fall victim to scams in the cryptocurrency space, especially those involving fraudulent investment platforms. However, I advise caution, as not all recovery services are legitimate. I personally lost $273,000 worth of Bitcoin from my Binance account due to a deceptive platform. If you have suffered a similar loss, you may be considering crypto recovery, The Capital Crypto Recover is the most knowledgeable and effective Capital Crypto Recovery Services assisted me in recovering my stolen funds within 24 hours, after getting access to my wallet. Their service was not only prompt but also highly professional and effective, and many recovery services may not be trustworthy. Therefore, I highly recommend Capital Crypto Recover to you. i do always research and see reviews about their service, For assistance finding your misplaced cryptocurrency, get in touch with them, They do their jobs quickly and excellently, Stay safe and vigilant in the crypto world.

You can reach them via email at Capitalcryptorecover@zohomail.com OR Call/Text Number +1 (336)390-6684 his contact: Recovercapital@cyberservices.com His website: https://recovercapital.wixsite.com/capital-crypto-rec-1

Joel Lucas

I’m here to bring you good news about THE HACK ANGELS. I lost $700,000 worth of Crypto to a fraudulent investment platform, due to the promises of high returns and I was left feeling helpless and frustrated. It was a painful experience, and I felt like I had no options left. I began looking for a genuine crypto recovery agent who could assist me retrieve my lost crypto. I searched the web to find legitimate and genuine assets recovery. After several searches I found THE HACK ANGELS. Cryptocurrency recovery specialists. I’m truly thankful for their help in recovering all I lost. If you need their service too, here is their contact information.

Email: support@thehackangels.com

Website at www.thehackangels.com

WhatsApp +1(520)200-2320

Joel Lucas

THE ONLY TRUSTED AND RELIABLE RECOVER HACKER // THE HACK ANGELS

I’m here to bring you good news about THE HACK ANGELS. I lost $700,000 worth of Crypto to a fraudulent investment platform, due to the promises of high returns and I was left feeling helpless and frustrated. It was a painful experience, and I felt like I had no options left. I began looking for a genuine crypto recovery agent who could assist me retrieve my lost crypto. I searched the web to find legitimate and genuine assets recovery. After several searches I found THE HACK ANGELS. Cryptocurrency recovery specialists. I’m truly thankful for their help in recovering all I lost. If you need their service too, here is their contact information.

Email: support@thehackangels.com

Website at www.thehackangels.com

WhatsApp +1(520)200-2320

alvinlees805

Someone cast a black magic spell to separate me and my husband! Dr. Excellent helped me to get my ex husband back after the separation. My Husband packed out to live with his mistress and he sent me divorce papers. I tried all I could to get him back but he refused to return home and I suspected the lady used some magic spell on him to hold him down. I got to know about Dr. Excellent in a YouTube comment where i was looking for help to get my husband back and i contacted him and explain my problem to him and he did the work and my husband return back home and he apologies for the pains he put me through and we are living happily together for good. if you need any kind of help you can also contact him for help. Here his contact. Call/WhatsApp him at: +2348084273514 "Or email him at: Excellentspellcaster@gmail. com

Elizabeth Rush

God bless Capital Crypto Recover Services for the marvelous work you did in my life, I have learned the hard way that even the most sensible investors can fall victim to scams. When my USD was stolen, for anyone who has fallen victim to one of the bitcoin binary investment scams that are currently ongoing, I felt betrayal and upset. But then I was reading a post on site when I saw a testimony of Wendy Taylor online who recommended that Capital Crypto Recovery has helped her recover scammed funds within 24 hours. after reaching out to this cyber security firm that was able to help me recover my stolen digital assets and bitcoin. I’m genuinely blown away by their amazing service and professionalism. I never imagined I’d be able to get my money back until I complained to Capital Crypto Recovery Services about my difficulties and gave all of the necessary paperwork. I was astounded that it took them 12 hours to reclaim my stolen money back. Without a doubt, my USDT assets were successfully recovered from the scam platform, Thank you so much Sir, I strongly recommend Capital Crypto Recover for any of your bitcoin recovery, digital funds recovery, hacking, and cybersecurity concerns.

You reach them Call/Text Number +1 (336)390-6684

His Email: Recovercapital@cyberservices.com

Contact Telegram: @Capitalcryptorecover

His website: https://recovercapital.wixsite.com/capital-crypto-rec-1

LilliansClark

https://profile.hatena.ne.jp/lilliansclark/

https://lebanonhub.app/blogs/265922/https-www-facebook-com-Viramax-Male-Enhancement-Official

https://lebanonhub.app/blogs/265923/Viramax-Male-Enhancement-Reclaim-Your-Vitality-Your-Journey-Starts-Here

https://lebanonhub.app/blogs/265924/Viramax-Male-Enhancement-Reviews-Legit-or-Fake-What-Do-Customers

https://lebanonhub.app/blogs/265925/Viramax-Male-Enhancement-Experience-the-Ultimate-Male-Upgrade-Don-t

https://wmasg.com/pl/forum/topic/259773-httpswwwfacebookcomviramaxmaleenhancementofficial/

https://wmasg.com/pl/forum/topic/259774-viramax-male-enhancement-customized-solutions-for-male-enhancement-tailored-to-you/

https://onlinegdb.com/11nqvax1S

https://www.portingkit.com/forum/showthread.php?tid=34482

https://www.squeegeeworld.com/threads/https-www-facebook-com-viramax-male-enhancement-official.20092/

https://www.squeegeeworld.com/threads/viramax-male-enhancement-boost-performance-naturally-%E2%80%93-results-you-can-trust.20093/

https://www.fipbo.com/events/2/

https://www.backdorf.de/forum/showthread.php?tid=16327

https://lilliansclark.alboompro.com/post/viramax-male-enhancement-customized-solutions-for-male-enhancement-tailored-to-you

https://lilliansclark.alboompro.com/post/viramax-male-enhancement-unleash-your-confidence-transform-your-performance-today

https://viramaxmaleenhancementus.godaddysites.com/

https://viramaxreviewsus.godaddysites.com/

https://nas.io/viramax-male-enhancement-us/challenges/viramax-male-enhancement-customized-solutions-for-male-enhancement-tailored-to-you

https://nas.io/viramax-male-enhancement-us/challenges/viramax-male-enhancement-reviews-legit-or-fake-what-do-customers-say

https://nas.io/viramax-male-enhancement-us/challenges/viramax-male-enhancement-boost-performance-naturally-results-you-can-trust

https://nas.io/viramax-male-enhancement-us/challenges/viramax-male-enhancement-the-key-to-lasting-energy-and-stamina-try-it-now

https://github.com/lilliansclark/Viramax-Male-Enhancement-Experience-the-Ultimate-Male-Upgrade-Don-t-Wait

https://github.com/lilliansclark/Viramax-Male-Enhancement-The-Key-to-Lasting-Energy-and-Stamina-Try-It-Now

https://www.facebook.com/Viramax.Male.Enhancement.Official/

https://www.facebook.com/groups/viramax.male.enhancement.official/

https://knowt.com/note/df0be7dc-8354-4a95-af9d-a6e7d57becf4/Viramax-Male-Enhancement-Enjoy-Your-Sex-

https://knowt.com/note/1c9ee63e-7844-4eb6-abfd-eff5ade79071/Viramax-Male-Enhancement-Breakthroughs-i

https://knowt.com/note/07c48917-8702-42f5-9db3-adf15e4f0ed5/Viramax-Male-Enhancement-Official-Websit

https://knowt.com/note/f7179a4a-a3ed-447a-92c0-b543e924289f/Viramax-Male-Enhancement-Official-USA

https://knowt.com/note/4dcad0ed-d1b9-4df1-a0c9-5ca58073dc5e/Mukonjo-Root-Male-Enhancement-Limited-Ac

https://knowt.com/note/f69196f0-123b-4fa7-83c7-0730d8ecddfc/Mukonjo-Root-Male-Enhancement-Your-Journ

https://knowt.com/note/07d77413-4b0d-485b-9aa4-08d59b40f9d8/Mukonjo-Root-Male-Enhancement-The-Hidden

https://knowt.com/note/3f46def0-9b95-424f-bd4c-4bab7d411c3f/Mukonjo-Root-Male-Enhancement-Say-Goodby

https://knowt.com/note/fac102cb-ee4a-4bcc-bde0-baf7b30d33c7/Mukonjo-Root-Male-Enhancement-Take-the-F

https://knowt.com/note/624c01d0-ce14-40f9-9be6-db2abbe7102f/Mukonjo-Root-Male-Enhancement-Clean-Saf

https://knowt.com/note/af2df526-3582-45c3-998b-bbca22620d0c/Mukonjo-Root-Male-Enhancement-Engineered

https://knowt.com/note/8eca9d40-8e5c-409e-8965-2cf198e92a60/Mukonjo-Root-Male-Enhancement-Boost-Your

https://knowt.com/note/28395169-6ce2-48cd-997a-2f97ded979e3/Mukonjo-Root-Male-Enhancement-Official-W

https://www.facebook.com/Mukonjo.Root.Male.Enhancement.Official/

https://www.facebook.com/groups/mukonjorootmaleenhancementofficial/

https://www.facebook.com/groups/mukonjo.root.reviews/

https://www.facebook.com/events/999167368974908/

https://mukonjo-root-male-enhancement.webflow.io/

https://mukonjo-root-male-enhancement-reviews.webflow.io/

https://sheilakayr.alboompro.com/post/mukonjo-root-male-enhancement-breakthroughs-in-male-enhancement-what-you-need-to-know

https://sheilakayr.alboompro.com/post/mukonjo-root-male-enhancement-customized-solutions-for-male-enhancement-tailored-to-you

https://nas.io/mukonjo-root-male-enhancement/challenges/mukonjo-root-male-enhancement-experience-the-ultimate-male-upgrade-dont-wait

https://nas.io/mukonjo-root-male-enhancement/challenges/mukonjo-root-male-enhancement-your-path-to-enhanced-size-and-performance-starts-today

https://mukonjorootofficial.godaddysites.com/

https://mukonjorootreviews.godaddysites.com/

https://colab.research.google.com/drive/1eOVUAvW8nouYboETkMAq5CZRPh_r794I?usp=sharing

https://colab.research.google.com/drive/10wpmNDNrOt0kime6LlI2Gb7EpBTTW8cF?usp=sharing

https://colab.research.google.com/drive/1HBlf86uVGnfOffJ9t9p3DSNM0clKPvLe?usp=sharing

https://knowt.com/note/3835a37d-3929-453e-b7d0-3b4e85a13a8b/Mukonjo-Root-Male-Enhancement-Breakthrou

https://knowt.com/note/3934a59b-3fba-4c28-a0f6-0c5875880f97/Mukonjo-Root-Male-Enhancement-Customized

https://knowt.com/note/aa15a4fb-6f91-4e59-8249-5d8307b69e4c/Mukonjo-Root-Male-Enhancement-Discover-t

https://www.italki.com/en/post/pEh20CEmhDF0bLH9wZ8RW0

https://www.italki.com/en/post/JqUoOC0TVLxD3elk45FqaA

https://www.italki.com/en/post/JqUoOC0TVLxD3elk45FquO

https://www.italki.com/en/post/JqUoOC0TVLxD3elk45FrPe

https://www.italki.com/en/post/pEh20CEmhDF0bLH9wZ8RxV

https://groups.google.com/g/mukonjo-root-male-enhancement-reviews/c/uwWBCmLU9OQ

https://groups.google.com/g/mukonjo-root-male-enhancement-reviews/c/7lINvv9ruuI

https://groups.google.com/g/mukonjo-root-male-enhancement-reviews/c/N_9rAGZ3-1Q

https://groups.google.com/g/mukonjo-root-male-enhancement-reviews/c/hsX6X-43tQo

https://github.com/SheilaKayr/Mukonjo-Root-Male-Enhancement-Reviews-USA

https://github.com/SheilaKayr/Mukonjo-Root-Male-Enhancement-Official

https://github.com/SheilaKayr/Mukonjo-Root-Male-Enhancement-Reviews-Official

https://mukonjo-root-male-enhancement-reviews.mywebselfsite.net/

https://mukonjo-root-male-enhancement-official-usa.mywebselfsite.net/

https://mukonjo-root-male-enhancement-reviews-usa.mywebselfsite.net/

https://asgardia.space/en/social/posts/166426

https://foro.ribbon.es/topic/72366/https-www-facebook-com-viramax-male-enhancement-official

https://foro.ribbon.es/topic/72367/viramax-male-enhancement-top-rated-male-enhancement-pills-boost-confidence-today

https://www.latinoleadmn.org/group/leadership-action-team/discussion/b702e05d-84d5-49b6-b299-6794854c4f83

https://www.latinoleadmn.org/group/leadership-action-team/discussion/c948ee11-3545-44e4-a091-2b9ef3f673a6

https://www.latinoleadmn.org/group/leadership-action-team/discussion/a246b369-2801-43f1-9258-c4d360be9e48

https://www.latinoleadmn.org/group/leadership-action-team/discussion/6111270a-84a3-4db9-afc4-383bea96bbf9

https://lamnongdan.com/agri/forum/main-forum/19929-viramax-male-enhancement-reviews-legit-or-fake-what-do-customers-say

https://lamnongdan.com/agri/forum/main-forum/19930-viramax-male-enhancement-experience-the-ultimate-male-upgrade-%E2%80%93-don%E2%80%99t-wait

http://www.uro-care.cz/ordinace-ricany.a1.html?page=1&r=1#posts

Patricia Lovick

How To Recover Your Bitcoin Without Falling Victim To Scams: A Testimony Experience With Capital Crypto Recover Services, Contact Telegram: @Capitalcryptorecover

Dear Everyone,

I would like to take a moment to share my positive experience with Capital Crypto Recover Services. Initially, I was unsure if it would be possible to recover my stolen bitcoins. However, with their expertise and professionalism, I was able to fully recover my funds. Unfortunately, many individuals fall victim to scams in the cryptocurrency space, especially those involving fraudulent investment platforms. However, I advise caution, as not all recovery services are legitimate. I personally lost $273,000 worth of Bitcoin from my Binance account due to a deceptive platform. If you have suffered a similar loss, you may be considering crypto recovery, The Capital Crypto Recover is the most knowledgeable and effective Capital Crypto Recovery Services assisted me in recovering my stolen funds within 24 hours, after getting access to my wallet. Their service was not only prompt but also highly professional and effective, and many recovery services may not be trustworthy. Therefore, I highly recommend Capital Crypto Recover to you. i do always research and see reviews about their service, For assistance finding your misplaced cryptocurrency, get in touch with them, They do their jobs quickly and excellently, Stay safe and vigilant in the crypto world.

You can reach them via email at Capitalcryptorecover@zohomail.com OR Call/Text Number +1 (336)390-6684 his contact: Recovercapital@cyberservices.com His website: https://recovercapital.wixsite.com/capital-crypto-rec-1

Michael Davenport

I was recently scammed out of $53,000 by a fraudulent Bitcoin investment scheme, which added significant stress to my already difficult health issues, as I was also facing cancer surgery expenses. Desperate to recover my funds, I spent hours researching and consulting other victims, which led me to discover the excellent reputation of Capital Crypto Recover, I came across a Google post It was only after spending many hours researching and asking other victims for advice that I discovered Capital Crypto Recovery’s stellar reputation. I decided to contact them because of their successful recovery record and encouraging client testimonials. I had no idea that this would be the pivotal moment in my fight against cryptocurrency theft. Thanks to their expert team, I was able to recover my lost cryptocurrency back. The process was intricate, but Capital Crypto Recovery’s commitment to utilizing the latest technology ensured a successful outcome. I highly recommend their services to anyone who has fallen victim to cryptocurrency fraud. For assistance, contact Recovercapital@cyberservices.com Capital Crypto Recover on Telegram OR Call Number +1 (336)390-6684 via email: Capitalcryptorecover@zohomail.com you can visit his website: https://recovercapital.wixsite.com/capital-crypto-rec-1

Grusso Lucas

REAL CRYPTO RECOVERY EXPERT // THE HACK ANGELS

The crypto market is very volatile and a lot of individuals have lost some of their crypto coins and crypto assets to these online scams. I was scammed over ( $798,000) by someone I met online on a fake investment project. I started searching for help legally to recover my money, and this left me devastated and depressed. I came across a lot of Testimonies about THE HACK ANGELS RECOVERY EXPERT. I contacted them providing the necessary information and it took the experts about 48 hours to locate and help recover my stolen funds. I’m very thankful for their help and I’m glad there is a safe way to fully recover crypto assets since the authorities cannot do anything to help get back lost funds. If you ever find yourself in a similar situation, THE HACK ANGELS RECOVERY EXPERT is who you need to turn to! YOU can contact them via:

WhatsApp +1(520)200-2320 ) or shoot them an Email at (support@thehackangels.com) They also have a great Website at (www.thehackangels.com )

Grusso Lucas

REAL CRYPTO RECOVERY EXPERT // THE HACK ANGELS

The crypto market is very volatile and a lot of individuals have lost some of their crypto coins and crypto assets to these online scams. I was scammed over ( $798,000) by someone I met online on a fake investment project. I started searching for help legally to recover my money, and this left me devastated and depressed. I came across a lot of Testimonies about THE HACK ANGELS RECOVERY EXPERT. I contacted them providing the necessary information and it took the experts about 48 hours to locate and help recover my stolen funds. I’m very thankful for their help and I’m glad there is a safe way to fully recover crypto assets since the authorities cannot do anything to help get back lost funds. If you ever find yourself in a similar situation, THE HACK ANGELS RECOVERY EXPERT is who you need to turn to! YOU can contact them via:

WhatsApp +1(520)200-2320 ) or shoot them an Email at (support@thehackangels.com) They also have a great Website at (www.thehackangels.com )

Grusso Lucas

REAL CRYPTO RECOVERY EXPERT // THE HACK ANGELS

The crypto market is very volatile and a lot of individuals have lost some of their crypto coins and crypto assets to these online scams. I was scammed over ( $798,000) by someone I met online on a fake investment project. I started searching for help legally to recover my money, and this left me devastated and depressed. I came across a lot of Testimonies about THE HACK ANGELS RECOVERY EXPERT. I contacted them providing the necessary information and it took the experts about 48 hours to locate and help recover my stolen funds. I’m very thankful for their help and I’m glad there is a safe way to fully recover crypto assets since the authorities cannot do anything to help get back lost funds. If you ever find yourself in a similar situation, THE HACK ANGELS RECOVERY EXPERT is who you need to turn to! YOU can contact them via:

WhatsApp +1(520)200-2320 ) or shoot them an Email at (support@thehackangels.com) They also have a great Website at (www.thehackangels.com )

Patricia Lovick

How To Recover Your Bitcoin Without Falling Victim To Scams: A Testimony Experience With Capital Crypto Recover Services, Contact Telegram: @Capitalcryptorecover

Dear Everyone,

I would like to take a moment to share my positive experience with Capital Crypto Recover Services. Initially, I was unsure if it would be possible to recover my stolen bitcoins. However, with their expertise and professionalism, I was able to fully recover my funds. Unfortunately, many individuals fall victim to scams in the cryptocurrency space, especially those involving fraudulent investment platforms. However, I advise caution, as not all recovery services are legitimate. I personally lost $273,000 worth of Bitcoin from my Binance account due to a deceptive platform. If you have suffered a similar loss, you may be considering crypto recovery, The Capital Crypto Recover is the most knowledgeable and effective Capital Crypto Recovery Services assisted me in recovering my stolen funds within 24 hours, after getting access to my wallet. Their service was not only prompt but also highly professional and effective, and many recovery services may not be trustworthy. Therefore, I highly recommend Capital Crypto Recover to you. i do always research and see reviews about their service, For assistance finding your misplaced cryptocurrency, get in touch with them, They do their jobs quickly and excellently, Stay safe and vigilant in the crypto world.

You can reach them via email at Capitalcryptorecover@zohomail.com OR Call/Text Number +1 (336)390-6684 his contact: Recovercapital@cyberservices.com His website: https://recovercapital.wixsite.com/capital-crypto-rec-1

alvinlees805

Oh my goodness this is amazing!

Thank to Dr Excellent for restoring my broken marriage in 11hours after 2 months of separation. My husband left me and moved to be with another woman. I felt my life was over and my kids thought they would never see their father again. I tried to be strong just for the kids but I could not control the pains that tormented my heart, my heart was filled with sorrows and pains because I was really in love with my husband. I have tried many options but he did not come back, until i met a friend that directed me to Dr. Excellent a spell caster, who helped me to bring back my husband after 11hours. Me and my husband are living happily together again, This man is powerful, Contact Dr. Excellent for any kind of spiritual problems or any kind of spell or relationship problems he is capable of making things right for you with no side effect. Don’t miss out on the opportunity to work with the best spell caster. Here his contact. Call/WhatsApp him at: +2348084273514 "Or email him at: Excellentspellcaster@gmail.com , His website:https://drexcellentspellcaster.godaddysites.com

Lillian Queen

FINALLY I GOT MY LOST BITCOIN BACK ALL THANKS TO // THE HACK ANGELS RECOVERY EXPERT

I am out here to spread this good news to the entire world on how THE HACK ANGELS RECOVERY EXPERT and his terams help me in recovering my lost Bitcoin. I never thought I could get scammed of my Bitcoin , I never knew these investments were fake. I was depressed and in anger but all thanks to THE HACK ANGELS RECOVERY EXPERT for the help and professional service offered to me in my time of need. I invested $1.3 million in a cryptocurrency platform and found out it was a scam and I had no idea how to get my money back until I contacted THE HACK ANGELS RECOVERY EXPERT To anyone out there seeking to recover any lost bitcoin from cryptocurrency forms of online scams or wallet hackers , I recommend THE HACK ANGELS RECOVERY EXPERT they specialize in recovery of lost funds. CONTACT DETAILS;

WhatsApp +1(520)200-2320 or shoot them an email at support@thehackangels.com They also have a great website at www.thehackangels.com

Lillian Queen

FINALLY I GOT MY LOST BITCOIN BACK ALL THANKS TO // THE HACK ANGELS RECOVERY EXPERT

I am out here to spread this good news to the entire world on how THE HACK ANGELS RECOVERY EXPERT and his terams help me in recovering my lost Bitcoin. I never thought I could get scammed of my Bitcoin , I never knew these investments were fake. I was depressed and in anger but all thanks to THE HACK ANGELS RECOVERY EXPERT for the help and professional service offered to me in my time of need. I invested $1.3 million in a cryptocurrency platform and found out it was a scam and I had no idea how to get my money back until I contacted THE HACK ANGELS RECOVERY EXPERT To anyone out there seeking to recover any lost bitcoin from cryptocurrency forms of online scams or wallet hackers , I recommend THE HACK ANGELS RECOVERY EXPERT they specialize in recovery of lost funds. CONTACT DETAILS;

WhatsApp +1(520)200-2320 or shoot them an email at support@thehackangels.com They also have a great website at www.thehackangels.com